Investing in a buy-to-let (BTL) property can be a smart way to generate income and build wealth. However, securing a BTL mortgage isn’t as simple as finding a lender and applying. Lenders take a close look at the property itself, not just the borrower, to determine if it’s a viable investment. Below, we’ll explore the main factors mortgage lenders consider when assessing a buy-to-let property so that you can make informed decisions and boost your chances of approval.

1. Property Location and Market Demand

Location is one of the first aspects lenders assess in a BTL property. They look for properties in areas with a strong demand for rentals, where tenant occupancy rates are consistently high. Urban areas, university towns, and commuter belts are generally favourable, as they tend to attract reliable rental demand.

From the lender’s perspective, a property in a high-demand location is less risky because it’s likely to stay occupied, ensuring steady rental income. For investors, choosing the right location also means minimizing the likelihood of void periods and potentially increasing rental yield over time.

2. Property Condition and Quality

Lenders also review the physical condition of the property. Properties in poor condition or needing extensive repairs may be seen as higher risk, as these issues can affect both rental demand and the property’s resale value. Most lenders prefer properties that are move-in ready or require minimal cosmetic upgrades.

When considering a BTL investment, it’s wise to ensure the property is in good repair and complies with local rental standards. Investing in improvements or completing essential renovations before applying for a mortgage can also improve a property’s appeal to lenders and tenants alike.

3. Property Type and Tenant Appeal

The type of property matters too, as lenders assess the suitability of the property for the rental market. Standard properties, such as flats and family homes, are generally straightforward for BTL mortgages, whereas more specialised properties, like holiday lets/serviced accommodation or Houses in Multiple Occupation (HMOs), may require additional checks or specialised mortgage products.

Some lenders are cautious with certain property types, such as:

- Ex-local authority properties – due to potential issues with tenant demand and resale value.

- Flats above commercial premises – which may face unique challenges with noise or tenant turnover.

- New-builds or high-rise flats – especially if the building has cladding concerns or restrictions.

If your investment is in a niche property type, we, at Grand Union Finance can help you to identify lenders who specialise in mortgages for that type of property.

You can book a call with one of our super-star brokers:

4. Expected Rental Income

Since rental income is a primary determinant of loan size for BTL mortgages, lenders place a lot of weight on expected rental yield. Lenders often use rental calculators and stress-testing methods to determine if the anticipated rental income can comfortably cover the mortgage payments.

Typically, lenders look for rental income to cover at least 125-145% of the monthly mortgage payments. They often apply a “stress-tested” interest rate (e.g., 7%) to ensure that the property will remain financially viable, even if interest rates rise. This means that before approving a mortgage, the lender will assess both current and projected rental income.

5. Loan-to-Value (LTV) Ratio

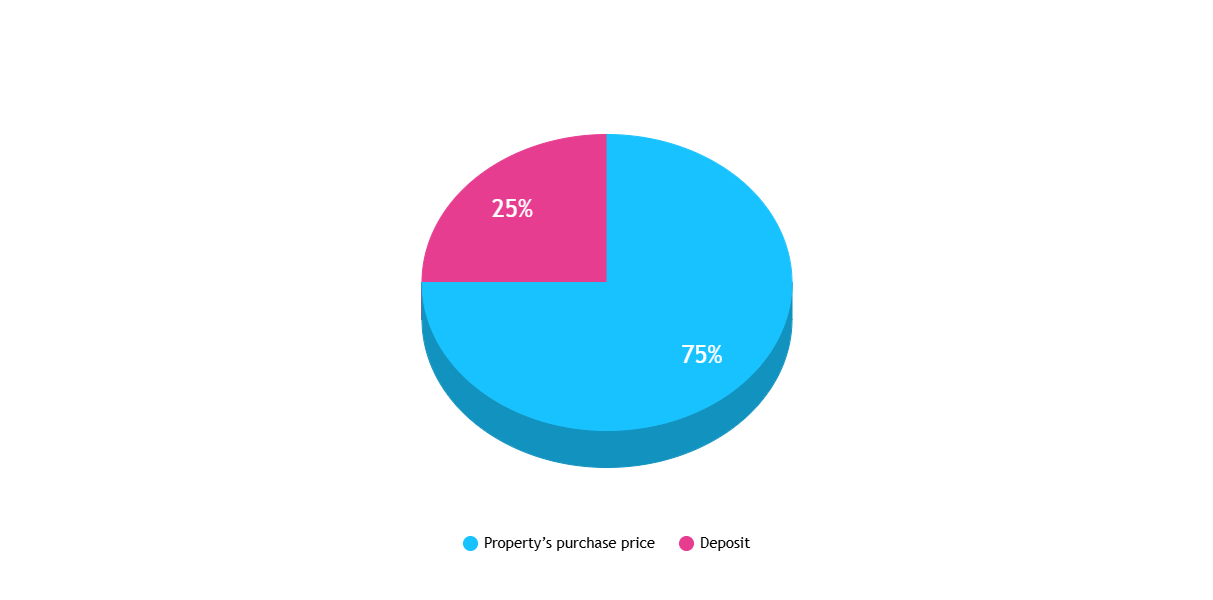

Most BTL lenders offer loans with a maximum loan-to-value (LTV) ratio of around 75%. This means the lender will cover up to 75% of the property’s purchase price, with the remaining 25% required as a deposit. Properties with higher LTVs are typically seen as higher risk, as they leave lenders with less equity as security.

To improve your chances of approval and secure better rates, aim to have a deposit of at least 25%. Some investors may opt for a lower LTV to access more favourable terms or to mitigate risk, particularly in uncertain markets.

6. Property Value Stability and Growth Potential

Lenders prefer properties in areas with stable or appreciating property values. While it can be difficult to predict market trends, investing in areas with positive growth indicators, like ongoing infrastructure projects or rising rental demand, can improve a property’s attractiveness to lenders.

For investors, properties in growth areas may offer capital appreciation, adding long-term value alongside rental income. However, it’s essential to balance growth potential with immediate rental demand to avoid potential void periods in newly developing areas.

7. Tenant Demographics and Stability

Finally, lenders may consider tenant demographics and the property’s potential for stable, long-term tenants. Family homes or properties in popular residential areas often attract longer-term tenants, which lenders view favourably due to the steady rental income.

On the other hand, properties in transient areas (e.g., near student campuses) may experience more turnover, requiring additional considerations. Some lenders may restrict borrowing on student lets or demand additional guarantees.

In Summary

When applying for a BTL mortgage, remember that lenders assess more than just your finances—they look closely at the property’s location, condition, type, expected rental income, LTV ratio, value stability, and tenant appeal. As an investor, understanding these factors and preparing accordingly can help you select properties that are not only profitable but also “mortgage-friendly.”

Whether you’re new to buy-to-let investing or looking to expand your portfolio, working with one of our experienced mortgage brokers here at Grand Union Finance, can be invaluable. Our brokers can guide you through lender requirements and identify products that align with your investment goals, maximising your borrowing potential and helping you secure favourable terms.

Facebook

LinkedIn

WhatsApp